The $44 Billion Decision That Changed Everything

February, 2008.

Microsoft makes an unsolicited offer to buy Yahoo for $44.6 billion, a 62% premium to Yahoo’s market value at the time.

Jerry Yang, Yahoo’s co-founder and CEO, had no desire to sell the company and would not make a counteroffer. When Yang demanded $4 more per share than Microsoft’s offer, the software giant walked away. The negotiations ended in failure in May 2008, and Yahoo’s stock price plunged. DealroomYahoo Finance

Yang was ultimately forced to resign from Yahoo in 2012, with shareholders blasting him for “pursuing an ineffective personal vision” and “impeding investment deals” that could have transformed the struggling company.

The perception among shareholders was that Yang was more focused on trying to rebuild Yahoo than on maximizing near-term shareholder value. AithorILCTR

Yang’s story illustrates a critical truth:

Research shows that 70% of business exits fail not due to financial issues, but because of emotional and psychological factors.

The founders who achieve both financial success and personal satisfaction in their exits share one critical trait: high emotional intelligence.

The Hidden Psychology of Deal Making

Most business owners prepare for exits by focusing on financial metrics, legal structures, and operational improvements. They optimize EBITDA, clean up their books, and hire the best advisors money can buy. But they overlook the most important factor: their own emotional readiness.

Buyers don’t just evaluate businesses; they evaluate the people behind them.

A founder’s emotional state affects every aspect of the deal process, from initial negotiations to post-closing integration.

Here’s why emotional intelligence determines exit success:

The Negotiation Advantage

Emotionally intelligent founders recognize their own triggers and biases. They understand when they’re making decisions from fear versus logic.

This self-awareness translates into stronger negotiating positions because they can:

- Separate ego from economics: They don’t take lowball offers personally or get offended by due diligence requests

- Read the room: They pick up on buyer concerns and motivations that others miss

- Manage their reactions: They stay calm under pressure and make strategic decisions even when stakes are high

- Build rapport: They connect with buyers on a human level, creating trust that facilitates smoother transactions

The Due Diligence Difference

Due diligence is inherently stressful. Buyers scrutinize every aspect of your business, questioning decisions you made years ago. Founders with high emotional intelligence handle this process differently:

They view questions as opportunities, not attacks.

When a buyer asks why revenue dipped in Q3 of 2024, an emotionally intelligent founder provides context without defensiveness. They understand that buyer questions often reveal areas where they can add value or demonstrate their expertise.

They maintain perspective during setbacks.

When buyers request additional information or negotiate terms, emotionally aware founders don’t catastrophize. They recognize that negotiation is a process, not a personal judgment on their worth as entrepreneurs.

The Four Pillars of Emotional Exit Readiness

Based on analysis of hundreds of successful exits, emotionally intelligent founders demonstrate mastery in four key areas:

1. Identity Separation

The Challenge:

Many founders struggle to separate their personal identity from their business identity. When someone critiques their company, they feel personally attacked.

The Solution:

Successful exiters develop what psychologists call “psychological distance.” They can discuss their business objectively, acknowledging both strengths and weaknesses without defensiveness.

Self-Assessment Question: Can you list three significant weaknesses in your business without feeling the need to immediately justify or defend them?

2. Loss Processing

The Challenge:

Selling a business involves multiple losses: loss of daily purpose, loss of control, loss of identity as “the founder.”

The Solution:

Emotionally prepared founders process these losses before entering negotiations. They’ve already grieved the end of one chapter so they can embrace the next.

Self-Assessment Question: Have you honestly confronted what you’ll miss most about running your business day-to-day?

3. Future Visualization

The Challenge: Many founders can’t articulate what they want their life to look like post-exit, making it impossible to structure deals that align with their true goals.

The Solution: They develop a clear vision of their post-exit life, including both financial and emotional objectives. This clarity guides decision-making throughout the process.

Self-Assessment Question: Beyond financial security, what do you want your life to look like two years after selling your business?

4. Relationship Intelligence

The Challenge:

Business exits involve complex relationships with buyers, employees, family members, and advisors. Founders must navigate competing interests and emotions.

The Solution:

They recognize that different stakeholders have different motivations and communicate accordingly. They’re skilled at managing expectations and maintaining relationships even during difficult conversations.

Self-Assessment Question: How well do you understand what each key stakeholder (employees, family, advisors) needs from your exit to feel satisfied?

The Neuroscience of Decision-Making Under Pressure

Recent neuroscience research reveals why emotional intelligence is so critical during high-stakes business transactions.

When we’re stressed or feel threatened, our brain’s amygdala (the “fight or flight” center) becomes hyperactive, and literally hijacks our prefrontal cortex (the logical decision-making center).

This means that during intense negotiations, founders often make decisions from an emotional state rather than a logical one. They might:

- Reject reasonable offers because they feel “insulted”

- Agree to unfavorable terms to avoid conflict

- Fixate on minor issues while missing major opportunities

- Misread buyer intentions and respond inappropriately

Emotionally intelligent founders have developed what researchers call “emotional regulation”: the ability to recognize when their emotions are driving decisions and pause to engage their logical thinking. Research shows that 90% of top performers have high emotional intelligence, proving how emotional intelligence skills impact success. The Role of Emotional Intelligence and Decision Making in Startup Leadership

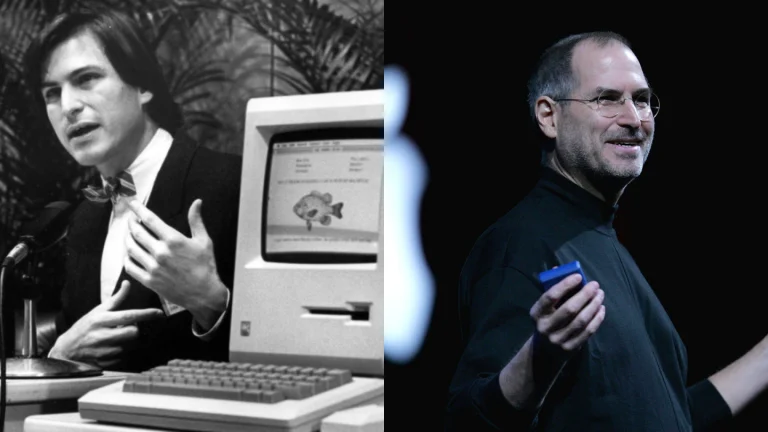

Learning from History: The Steve Jobs Evolution

One of the most remarkable examples of emotional intelligence development in business history is Steve Jobs.

In 1985, Jobs was pushed out of Apple due to clashes with the board, largely because of his overbearing, impatient, and arrogant leadership style. But over the next decade at NeXT, Jobs grew and matured emotionally. When he returned to Apple in 1997, he led one of the most remarkable turnarounds in history. StudyCorgiInc.com

“Steve wasn’t born with those skills. He developed them,” wrote former Business Insider editor-in-chief Henry Blodget. “In Steve’s last 13 years at the company,

Apple accomplished more than anyone could ever had dreamed of on the product side and also became the world’s most profitable and valuable company. And Steve’s leadership was critical to both… Steve learned the skills and discipline that he needed to lead Apple’s resurrection.” Steve Jobs’ Leadership Style and Emotional Intelligence | Free Essay Example

The lesson: Emotional intelligence isn’t fixed. It can be developed, and the payoff for that development can be extraordinary, and leads to deal success.

Practical Strategies for Emotional Exit Preparation

The 90-Day Emotional Readiness Program

Days 1-30: Self-Discovery

- Complete a comprehensive emotional assessment (consider working with a business psychologist)

- Journal daily about your relationship with your business

- Identify your emotional triggers and patterns

- Begin separation exercises (delegate more, take longer vacations)

Days 31-60: Scenario Planning

- Practice describing your business to strangers objectively

- Role-play difficult conversations with trusted advisors

- Visualize and write about your ideal post-exit life

- Address any unresolved conflicts with key stakeholders

Days 61-90: Integration

- Implement emotional regulation techniques (meditation, breathing exercises)

- Build your support network (therapist, peer groups, mentors)

- Practice receiving feedback without defensiveness

- Conduct a “practice exit” conversation with a trusted advisor

The Emotional Intelligence Toolkit

Before Important Meetings:

- Use the “STOP” technique: Stop, Take a breath, Observe your emotions, Proceed with intention

- Visualize successful outcomes rather than worst-case scenarios

- Set emotional as well as business objectives for each meeting

During Negotiations:

- Monitor your physical state (tension, breathing, heart rate)

- Use the “24-hour rule” for major decisions

- Ask clarifying questions when you feel triggered

- Take breaks when emotions run high

After Difficult Conversations:

- Process emotions with your support network

- Separate facts from interpretations

- Identify lessons learned for future interactions

- Maintain perspective on the larger goal

The ROI of Emotional Intelligence

Founders who invest in emotional intelligence see measurable returns. Research shows that startups with emotionally intelligent leaders are 60% more likely to succeed, and that emotionally intelligent leaders increase employee retention by 50%. The Role of Emotional Intelligence and Decision Making in Startup Leadership

Higher Valuations: Buyers pay premiums for businesses run by emotionally stable founders who can facilitate smooth transitions.

Faster Processes: Emotionally intelligent founders make decisions more quickly and navigate obstacles more efficiently.

Better Terms: They’re more likely to negotiate favorable deal structures because they can separate emotions from economics.

Post-Exit Satisfaction: They report higher levels of satisfaction with their exits because their decisions aligned with their true values and goals.

Red Flags: When Emotions Derail Exits

Watch for these warning signs that emotions might be sabotaging your exit:

- Perfectionism paralysis: Refusing to move forward until everything is “perfect”

- Reactive decision-making: Making major decisions immediately after emotional conversations

- Advisor shopping: Constantly changing advisors when you don’t like their recommendations

- All-or-nothing thinking: Viewing every negotiation point as make-or-break

- Isolation: Withdrawing from trusted advisors or support networks

Identity crisis: Feeling lost or worthless when discussing life after the business

Learning from Emotional Attachment: The Founder's Dilemma

According to research by Harvard Business School’s Noam Wasserman, after three years of existence, 50% of founders are no longer running their company.

However, founders generally do not give up easily and four out of five entrepreneurs leaving their CEO positions are forced to do so. This emotional attachment can become their Achilles’ heel, as they call their business their “baby” and devote themselves entirely to their project, whether it is profitable or not. Managing negative emotions from entrepreneurial project failure: When and how does supportive leadership help employees? – ScienceDirect

The psychological challenges are real.

As psychiatric researcher Michael A. Freeman notes, “People who are on the energetic, motivated, and creative side are both more likely to be entrepreneurial and more likely to have strong emotional states.”

Those states may include depression, despair, hopelessness, worthlessness, loss of motivation, and suicidal thinking during business transitions. It’s Complicated – Interview with Jerry Yang | Startups.com

Building Your Emotional Exit Team

Just as you wouldn’t attempt a complex transaction without financial and legal advisors, don’t navigate the emotional aspects alone. Consider building a team that includes:

Business Psychologist: Someone who specializes in helping entrepreneurs with transitions

Peer Group: Other business owners who have successfully exited

Executive Coach: A professional who can help you develop emotional regulation skills

Trusted Advisor: A mentor who can provide objective perspective

Family Counselor: Someone to help your family navigate the changes

The Long Game: Emotional Intelligence as Strategic Advantage

Developing emotional intelligence isn’t just about surviving your exit; it’s about thriving in whatever comes next. The same skills that help you navigate a business sale will serve you whether you’re:

- Starting your next venture

- Joining a board of directors

- Becoming an investor

- Focusing on family and personal interests

The most successful entrepreneurs understand that emotional intelligence isn’t a soft skill; it’s a strategic advantage that compounds over time.

Your Next Steps

Before you optimize another financial metric or hire another advisor, invest in your emotional readiness. Start with these three actions:

- Complete an honest self-assessment: Can you objectively discuss your business’s strengths and weaknesses? Do you have a clear vision for your post-exit life?

- Build your support network: Identify the people who can help you process emotions and maintain perspective throughout the exit process.

- Practice emotional regulation: Develop techniques for managing stress and making decisions from logic rather than emotion.

The deals that create the most wealth and satisfaction aren’t won by the smartest founders or the most valuable companies. They’re won by founders who understand that the most important negotiation happens within themselves.

Your emotional intelligence will determine not just whether you successfully exit your business, but whether you successfully transition to the next chapter of your life.

The question isn’t whether you can afford to invest in emotional readiness; it’s whether you can afford not to.

At 9Q Exit, we understand that successful exits require more than financial engineering. Our team includes business psychologists and transition specialists who help founders navigate the emotional complexities of business exits.

Contact us to learn how we can help you achieve both financial success and personal satisfaction in your transition.