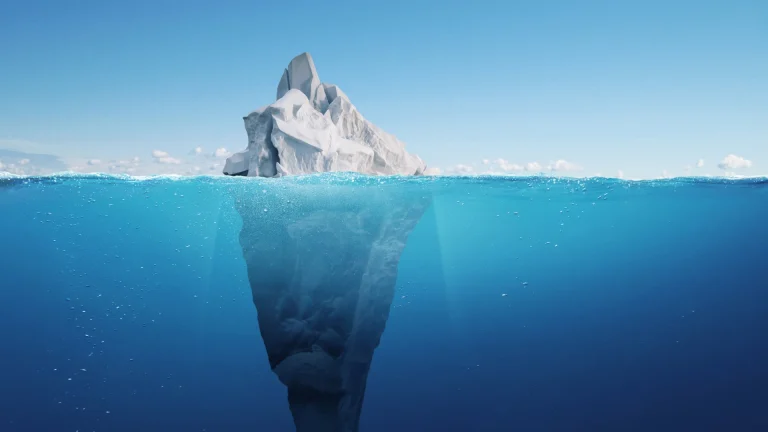

Let’s say an IT services company is built around one golden relationship. A Fortune 500 manufacturer had grown to represent 60% of their revenue over eight years—steady, predictable, profitable work that funded the owner’s lifestyle and his team’s paychecks. But what looked like stability to him turned out to be a serious exit risk in the eyes of potential buyers.

Instead, they saw it as a ticking time bomb.

Three potential buyers walked away before due diligence even began. The fourth offered 40% below his asking price with the blunt explanation: “We’re not buying a business—we’re buying a contract that could disappear tomorrow.”

Many discover the hard way that in the world of business valuations, your biggest strength can become your biggest weakness.

Why Customer Concentration Happens (And Why It Feels So Right)

The path to dangerous concentration is seductive and logical:

The Efficiency Trap: Large customers offer economies of scale. It’s easier to serve one client with $2M needs than twenty clients with $100K needs. Lower sales costs, streamlined operations, predictable workflows.

The Relationship Investment: You hire people who specialize in this customer’s industry. You invest in systems that integrate with their processes. You become genuinely good at serving their specific needs.

The Growth Accelerator: When your anchor customer grows, you grow. When they expand to new locations or launch new projects, you’re first in line. It feels like partnership, not dependence.

The Comfort Zone: Predictable revenue reduces stress. You know what’s coming each quarter. Budgeting becomes straightforward. The business feels stable and manageable.

But comfort and value creation often move in opposite directions.

The Hidden Vulnerabilities That Buyers See

Experienced acquirers know that concentrated customer relationships carry risks that even good clients can’t control:

Personnel Risk: Your primary contact retires, gets promoted, or leaves for a competitor. The new decision-maker wants to “bring in their own people” or renegotiate terms.

Budget Cycle Risk: Economic downturns hit large companies first and hardest. Your anchor client faces pressure to cut contractor spending or consolidate vendors.

Strategic Shift Risk: Your customer changes business focus, gets acquired, or pivots their strategy in ways that reduce their need for your services.

Competitive Pressure Risk: Your customer faces margin pressure and demands price concessions from all vendors. You either sacrifice profitability or risk losing the relationship.

Procurement Policy Risk: New policies require competitive bidding, multiple vendor relationships, or different qualification criteria that you might not meet.

The Diversification Dilemma: Growth vs. Risk Management

Diversifying your customer base creates its own challenges:

Resource Allocation: Pursuing smaller customers requires different sales approaches, marketing strategies, and operational capabilities. Your team is optimized for large client service.

Margin Pressure: Smaller customers often demand more attention per dollar of revenue. Your cost structure, built around large client efficiency, might not support profitable small client relationships.

Market Position: You’ve become known as “the company that serves [Big Customer].” Other prospects might view you as specialists in someone else’s industry rather than experts in their needs.

Time Investment: Customer diversification takes years, not months. New relationships require cultivation, trust-building, and proof of capability.

Strategies That Work: Diversification Without Destruction

Smart business owners approach customer diversification strategically rather than desperately:

The Geographic Expansion Model

If your anchor customer has multiple locations, use your expertise with them to serve similar companies in different markets. A manufacturing services company that served Ford in Detroit used that experience to land GM contracts in other states.

The Service Line Extension

Leverage your anchor relationship to develop new capabilities, then market those services to other customers. An accounting firm that built specialized inventory management systems for one retail client eventually licensed that expertise to competitors.

The Partner Channel Strategy

Find complementary service providers who serve your target customer segments and develop referral relationships. A cybersecurity consultant partnered with HR consulting firms to reach mid-market companies without building new sales capabilities.

The Industry Adjacent Approach

Move into industries that share similar operational characteristics or regulatory requirements. A logistics company serving automotive manufacturers expanded into aerospace, leveraging similar compliance and operational expertise.

Protecting Your Anchor While Building Alternatives

The key is managing this transition without damaging your core relationship:

Transparency Strategy: Keep your anchor customer informed about your growth plans. Frame diversification as business stability that ensures your long-term ability to serve them.

Resource Protection: Ring-fence resources dedicated to your anchor customer. Ensure service quality doesn’t suffer while you’re developing new business.

Contract Optimization: Use renewal negotiations to secure longer terms, clearer scope definitions, and mutual exclusivity agreements that protect both parties.

Succession Planning: Build multiple relationships within your anchor customer organization. Reduce dependence on single decision-makers.

The Timeline Reality: Start Before You Need To

Here’s the harsh truth about customer diversification: it takes 2-3 years to meaningfully shift revenue concentration. If you’re planning to sell within 18 months, major customer diversification isn’t realistic.

Instead, focus on:

Contract Strengthening: Secure longer terms, broader scope, or penalty clauses that make customer departure expensive.

Relationship Documentation: Create written records of customer satisfaction, renewal history, and expansion opportunities that demonstrate relationship stability.

Market Positioning: Develop case studies and credentials that show your expertise extends beyond your anchor customer.

Operational Excellence: Document the systems and processes that make you valuable to any large customer, not just your current one.

The Valuation Upside of Getting This Right

Companies that successfully diversify customer concentration while maintaining anchor relationships often see dramatic valuation improvements:

- Multiple Expansion: Moving from 60% to 30% customer concentration can increase valuation multiples by 50-100%

- Buyer Competition: Diversified revenue streams attract both strategic and financial buyers, creating competitive bidding

- Risk Reduction: Lower customer concentration reduces buyer financing costs and due diligence concerns

- Growth Potential: Diversified businesses can more easily scale post-acquisition

Your Customer Portfolio as Exit Strategy

The most valuable businesses are built around customer portfolios that demonstrate market validation, operational scalability, and revenue predictability.

Your biggest customer relationship might be the foundation of your business, but it shouldn’t be the ceiling. Start diversifying now, not because you don’t trust your anchor relationship, but because the buyers who will eventually acquire your business need to trust that your success isn’t dependent on relationships they can’t control.

The ultimate goal is to build a business so fundamentally strong that no single relationship, however valuable, can make or break your exit strategy.